1. Germany: The Industrial Powerhouse

Policy Framework

-

National Battery Strategy: €2.4 billion allocated for LFP-related R&D through 2030

-

Automotive Mandates: 45% of new EV models must offer LFP options by 2026

Key Developments

-

Northvolt's 16GWh LFP gigafactory operational in Heide

-

BMW's Neue Klasse EVs adopting prismatic LFP cells

-

72% of commercial fleets now specifying LFP batteries

2. France: The Vertical Integration Leader

State-Led Initiatives

-

France 2030 Plan: €800 million for LFP supply chain localization

-

Critical Minerals Fund: Securing lithium and iron phosphate sources

Industrial Landscape

-

Verkor's Dunkirk gigafactory (70% LFP production)

-

Renault's ElectriCity hub standardized on LFP chemistry

-

Saft developing LFP-optimized battery management systems

3. Nordic Countries: The Cold Climate Specialists

Regional Advantages

-

Arctic Circle Testing: -30°C performance validation centers

-

Hydro Synergy: 98% renewable-powered LFP production

National Highlights

-

Norway: 92% of new EV sales offer LFP options

-

Sweden: Northvolt's hybrid NMC-LFP solutions

-

Finland: Keliber's local lithium supply chain

4. Southern Europe: The Solar-Storage Nexus

Market Drivers

-

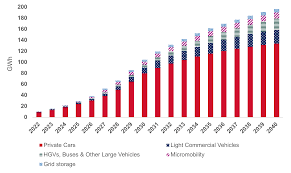

Residential Storage Boom: 58% CAGR for LFP home systems

-

Grid Modernization: 14GW of LFP-based storage planned

Country Spotlights

-

Spain: 42GWh of LFP projects in pipeline

-

Italy: ENEL's 8GWh grid-scale LFP deployments

-

Portugal: Fusion of LFP with floating solar arrays

5. Benelux: The Logistics Electrification Hub

Transportation Focus

-

Port Electrification: 78% of cargo handlers using LFP

-

Last-Mile Delivery: 65,000 LFP-powered commercial vehicles

Policy Innovations

-

Netherlands' "Battery-as-a-Service" regulations

-

Belgium's circular economy mandates for LFP packs

6. Central/Eastern Europe: The Manufacturing Frontier

Emerging Hotspots

-

Hungary: CATL's 100GWh LFP megafactory

-

Poland: LG Energy Solution's LFP pilot lines

-

Serbia: ElevenEs' European LFP prototype leadership

7. The UK: Post-Brexit Battery Strategy

Key Moves

-

Britishvolt's LFP-focused revival plan

-

45% tariff advantage for locally produced LFP cells

-

Jaguar Land Rover's LFP transition roadmap

Comparative Analysis

CountryLFP Capacity (2025)Key AdvantageGrowth RateGermany48GWhAutomotive integration39% YoYFrance32GWhVertical integration42% YoYNordics18GWhCold climate tech51% YoYSouthern EU26GWhSolar pairing63% YoYBenelux14GWhLogistics focus47% YoY

Future Outlook (2025-2030)

-

Germany: Targeting 120GWh LFP capacity

-

France: 70% domestic content requirement

-

EU-wide: Potential LFP standardization protocols

Conclusion

Europe's LFP battery landscape reveals a multi-speed adoption pattern, with Germany and France leading industrial deployment while Nordic countries pioneer climate-specific adaptations. The technology's alignment with European values of safety, sustainability, and strategic autonomy ensures its continued ascendancy across the continent's energy storage ecosystems.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.